Consumer Duty

Rivers Capital Management Limited (Rivers) is subject to the FCA’s Consumer Duty (“Duty”) rules, specifically in our role as a Discretionary Fund Manager and manufacturer. As such we are required to take appropriate steps to ensure our products remain compatible with the intended target market and chosen distribution strategy.

To meet our regulatory obligations, we have reviewed our existing arrangements, governance, investment strategies, policies, and procedures, etc. in order to identify any required enhancements to our current processes and procedures in light of the Duty.

In accordance with the new regulation, we have undertaken a review of:

• Target market information.

• Fair value assessment.

• Financial performance.

What information is Rivers Capital going to provide to retail distributors?

Rivers Capital will provide example client statements, value assessments and detailed portfolio investment parameters to distributors in relation to the Model Portfolios we manage, and which are available to UK retail customers. The scope of shared data will include:

• A summary of a target market for whom our products are designed, which takes into account customers with characteristics of vulnerability.

• Information on overall prices and/or fees.

• Our assessment of the total costs and value assessment by portfolio.

• Individual model portfolio parameters.

• Financial performance analysis.

In addition, Rivers will continue providing Portfolio data for Rivers advised portfolios via factsheets and rebalance notes.

What are our expectations of UK retail distributors under the Duty?

To help us ensure we provide products designed to meet the needs of UK retail customers within the scope of our target market, we expect distributors, who sell to UK retail customers, to share information with us under the Duty: We would expect you to inform us in the following cases:

• If there are any issues identified by a distributor of our products in relation to our target market assessment.

• If there are any issues identified by a distributor during your ongoing review of our products.

• If any issues are identified by a distributor or for customers of our products with regards to the product’s characteristics of vulnerability, to let us know what they are.

• If any offering of our products outside the target market or any harm to UK retail customers is foreseen as a result of such offering, we also expect that distributor to inform us.

Target Market Information

Rivers Capital Management’s Model Portfolio Service (MPS) is a discretionary investment management service designed for retail clients and their advisers. The service offers a range of pre-built portfolios that are tailored to different risk profiles and investment objectives.

Rivers Capital Management MPS is only available to retail clients who are independently financially advised. The service is designed to complement the advice that the client is receiving from their financial adviser. The adviser can use the MPS portfolios as a starting point for developing an investment strategy that meets the client’s individual needs and objectives.

The Rivers Model Portfolio Service is suitable for clients who:

· Are a retail client.

· Have an investment horizon over the medium-to-long-term (five years+).

· Have a capacity for loss.

· Have an FCA Regulated financial adviser.

The Rivers Model Portfolio Service is not suitable for those who:

· Have a risk profile that is not aligned with that of the model portfolios.

· Cannot bear a loss of capital or require a guaranteed income or return.

· Do not have a financial adviser.

· Have a short-term view to investments (less than five years).

Accessing the Rivers Model Portfolios:

The Model Portfolio Service is available on a number of Discretionary platforms and can be accessed via various product wrappers, depending on the platform, such as:

· Investment Account

· SIPP

· ISA

· JISA

· Bond

The Rivers Model Portfolio Service provides model portfolios suitable for investors with varying degrees of risk appetite, from the lower risk ‘Preservation’ model to higher risk ‘Aggressive’ model. The client’s risk profile should be aligned to the chosen model.

Please find in the appendix to this note, the investment parameters or constraints/objectives for each Model Portfolio offered to your clients by Rivers Capital Management. In addition, we have written sample investment policy statements as an example for a client, which we consider appropriate for each portfolio. These notes are for indicative purposes only. The individual portfolio parameters are designed to meet the needs of each target market and avoid causing foreseeable harm. Ultimately the objective of the portfolio parameters is to enable customers to achieve good outcomes and have reasonable expectations met. Our aim is to provide sufficient information to you, as distributor, to help inform your client assessment, particularly and needs and requirements that might be relevant for customers with characteristics of vulnerability.

Price and Value Outcome

Under the Consumer Duty, we are obliged to conduct a Price and Value assessment against all the products and services that we ‘manufacture’. This assessment must ensure that all our products and services provide fair value to the client based on the price the client pays.

To assess the Price and Value of our ‘manufactured’ products and services, we have broken down our analysis into three components: costs, performance, and service.

Costs:

Expected total costs – We have conducted analysis for each of our products and services, the underlying fund costs, including all transaction costs and the fee charged by Rivers. We understand that individual Financial Advisers may have different charging structures, as do different platforms. These costs are not necessarily disclosed to Rivers and as a result our assessment, and set limits, are net of these expenses.

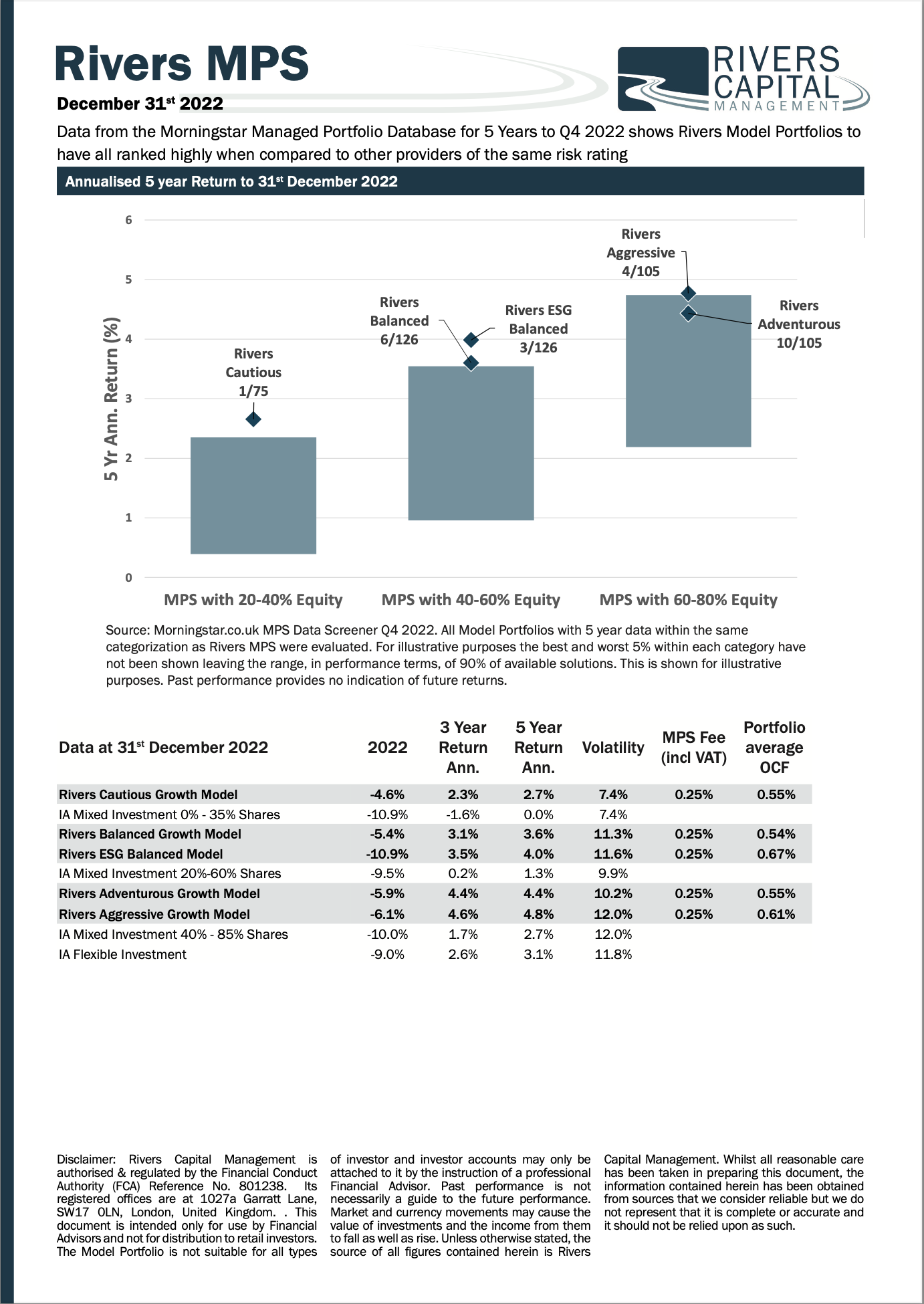

Comparable market rates – We have compared the fee charged by Rivers, and the underlying portfolio cost against other comparable rates in their markets and found them to be good value.

Within the appendix of this note the Portfolio Parameters for each Model Portfolio contain total cost constraints.

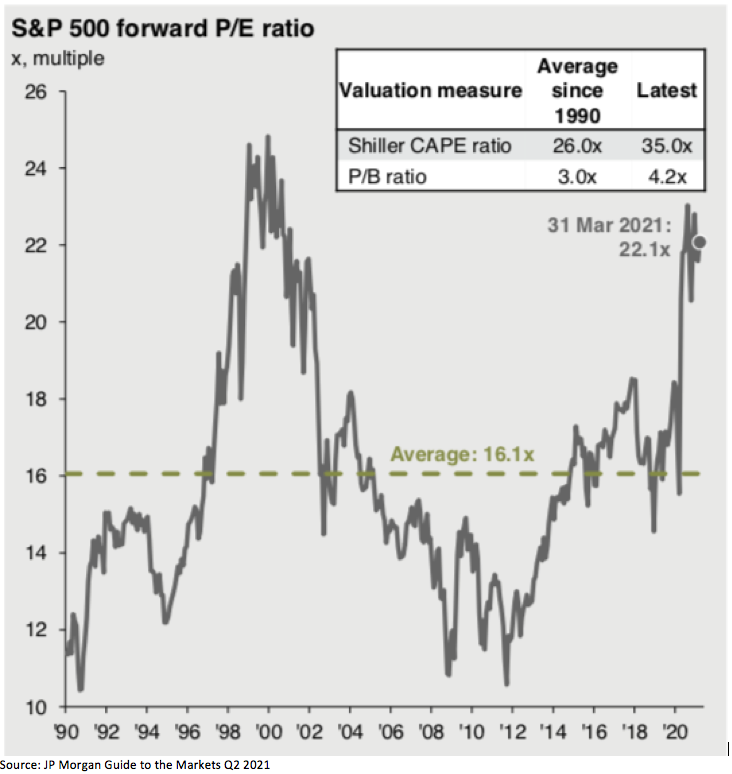

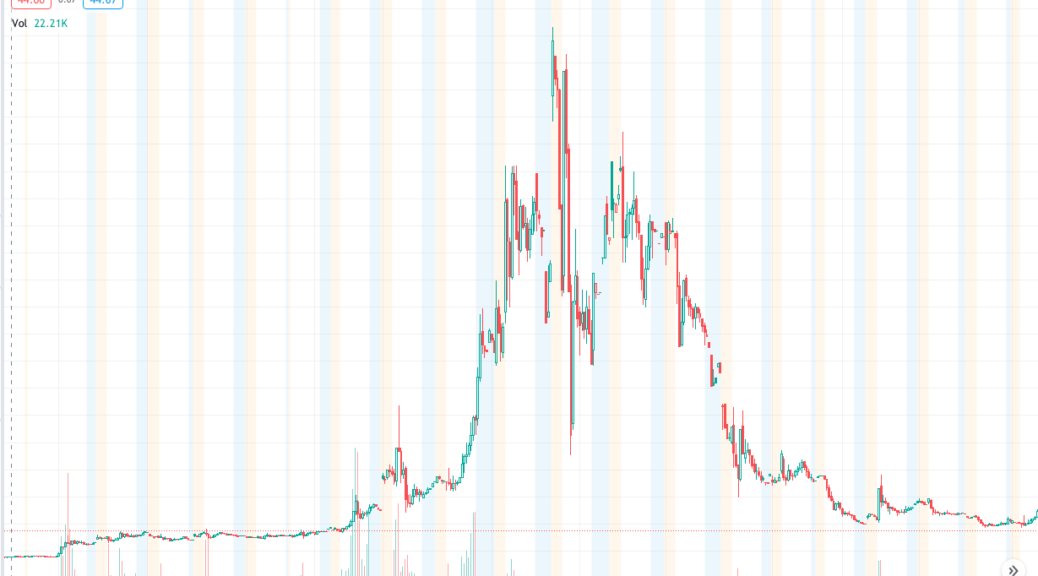

Performance:

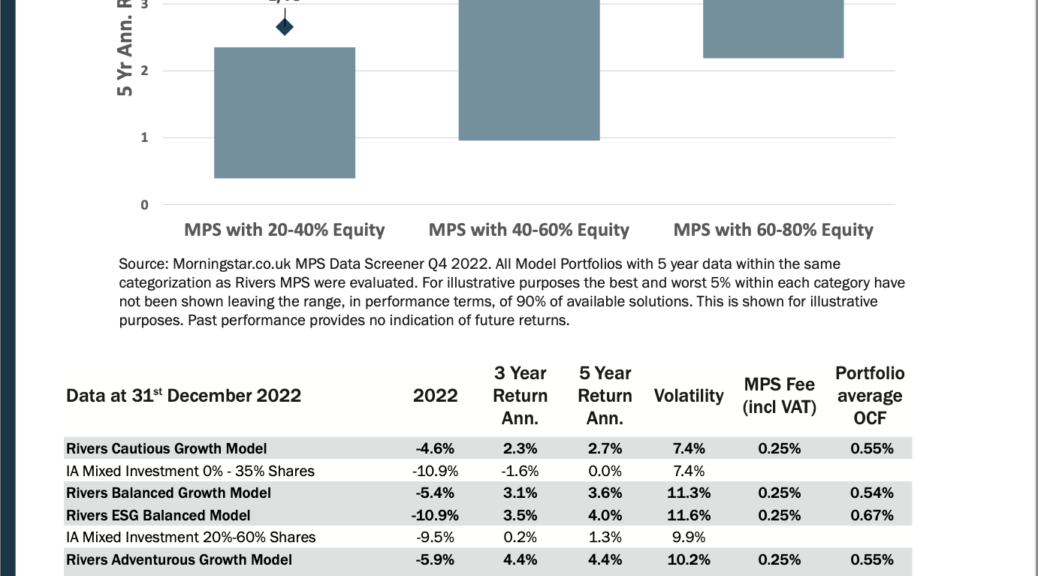

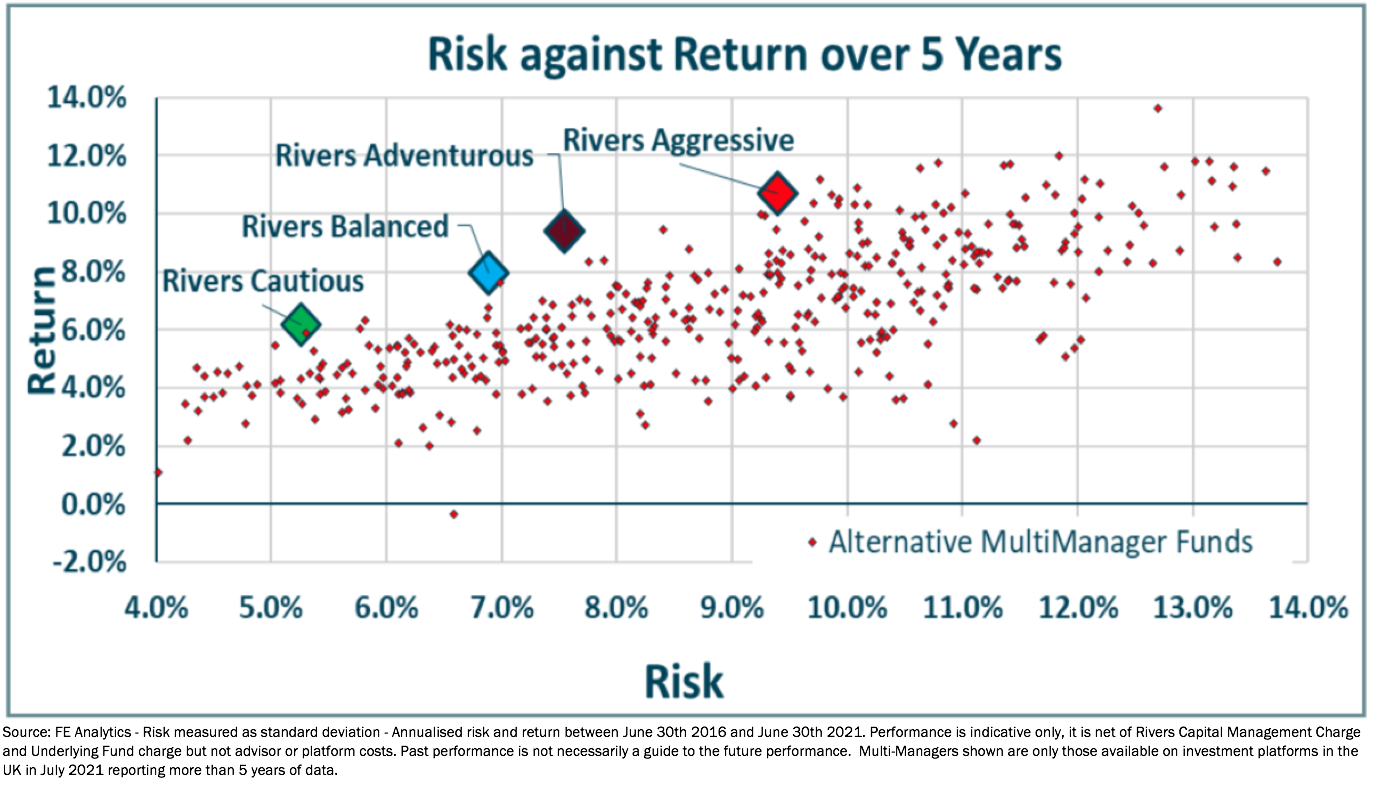

When analysing performance, we assess whether the delivery of the product or service is achieving good outcomes for customers. This has been completed through the collection of internally measured key performance indicators. The performance of the investment strategy has been evaluated against similar products available as well as generally recognised market benchmarks.

In the appendix to this note please find individual model portfolio performance analysis.

Service:

When analysing service, we have looked at whether the service we provide to customers is in line with their needs and expectations. This has been completed through the collection of internally measured service level agreements, the number and severity of complaints against each product and service and any feedback received, whether directly or through third-party market researchers.

A conclusion was then reached at each product or service level, as to whether we provide fair value to clients and whether we had any products, services or processes that may cause client harm or could be improved to provide better value to the client.

Based on our assessment looking at cost, performance and service, we have concluded that the Rivers MPS provides fair value to the target market.

Consumer Understanding Outcome

Rivers Capital Management’s Model Portfolio Service (MPS) meets the consumer duty requirement surrounding consumer understanding in a number of ways.

First, Rivers provides clear and transparent information about its investment process and fees. The firm’s website provides detailed information about its MPS portfolios, including the underlying assets, risk profile, and fees.

Second, Rivers provides distributors with ongoing support. The firm’s website includes a blog and a library of educational resources that help clients to understand the Rivers investment process and risk management. The firm also offers access to a team of experienced investment professionals who can answer their questions and provide portfolio information.

Third, Rivers requires distributors to complete, on behalf of clients, a risk assessment before they can recommend investment to Rivers MPS portfolios. The risk assessment helps to ensure that the portfolios are appropriate for the client’s individual needs and objectives.

Fourth, Rivers provides distributors with regular updates on any model portfolios made available to them. Rivers sends monthly factsheets, market commentary and updates to any allocation changes. Any portfolio changes are communicated in easy to understand rebalance notifications which justify all changes made. This also confirms continued compliance within the portfolio parameters agreed for each Model Portfolio.

By providing clear and transparent information Rivers Capital Management meets the consumer duty requirement surrounding consumer understanding. This helps to ensure that its clients, assisted by their regulated Adviser, are able to make informed decisions about their investments.