The Pandemic One Year On

This time last year countries around the world were beginning to formulate strategies of how to tackle the Covid-19 pandemic. They realised that drastic action was required to contain the spread of the virus and mitigate economic damage. Many governments concluded that without fiscal and monetary intervention, a crisis unlike any seen since the great depression was a distinct possibility. A year on, while there is still a long way to go before we can say that the pandemic is over, there are some bright spots on the horizon. Arguably the most important is that both the US and the UK have implemented successful vaccination campaigns, with the US announcing 3 million vaccines given per day and the UK approaching the milestone of 50% of the population having been given at least one dose. This month we look at the likely routes out of the pandemic for economies and where the best tactical investment allocations lie.

US Stimulus

We can already see business cycle indicators showing that the global economic recovery is underway. This has been driven to a large extent by the strength of the US economy and the pent-up spending potential of US households as they receive their latest stimulus cheques. So far during the pandemic, stimulus payments to households now total around $3 trillion, this is equal to 20% of US personal consumption and is three times as much as was paid out during the global financial crisis. If this stimulus money hits the economy as fast as economists are predicting, this will be beneficial for many sectors from leisure and hospitality to retail and financials but may well highlight supply constraints.

Jobs Recovery

We think that the best pockets of upside lie within those sectors that are at the value end of the market. Growth stocks have been the real drivers of stock market performance since the Financial Crisis but it seems that a value cycle may now finally be underway. The major caveat to a strong US market is that strong financial conditions will bring inflation back into the equation, especially if tight labour market conditions trigger sharp wage increases. In spite of the surge in new jobs in March, total payrolls are still 8.4 million short of where they were pre-pandemic, but given that payroll figures were a third higher than estimates, things are going in the right direction.

What is difficult to ascertain is how much of the good news has been discounted by the market. We believe that a significant amount has and this will likely lead to increased volatility as multiples are hitting historic peaks, medium term interest rates are rising and tax hikes are being debated in congress. It is volatility stoked by the uncertainty around these factors in which we see the best opportunities for our clients.

UK Return to Growth

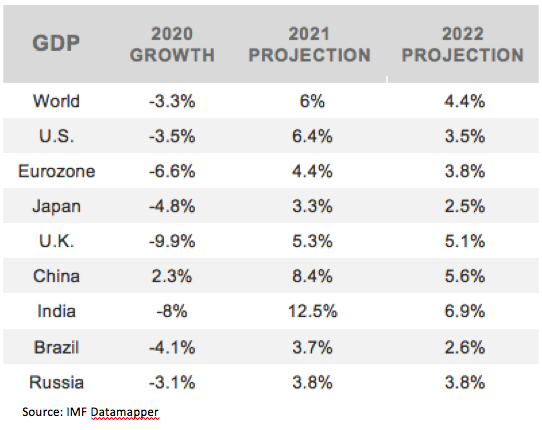

The UK’s growth rate has suffered more than most developed economies partly due to the poor initial handling of the pandemic and potentially, the hidden impact of Brexit, which is ongoing. Moving forward, this has been offset to some extent by the speed of the vaccine roll-out, to the extent that the IMF has just revised upwards its 2021 growth rate for the UK economy from 4.5% to 5.3%. The UK market remains undervalued compared to its peers but caution is warranted given the headwinds. These headwinds include the huge debt to GDP burden and the unresolved issues of the post Brexit economy.

Europe slow on vaccine roll-out but markets strong

Our European neighbours have been publicly battling a shortage of vaccines as the virus spread continues. A third wave has forced some countries into further lockdowns which pushes economic recovery further out. Despite the slow rollout and the new lockdowns, Eurozone markets have significantly outperformed other global markets. During March many EU indices, including the German Dax 30 and the French CAC 40 materially outperformed both the S&P 500 and the FTSE All Share. Since late 2020, the region has benefited from the rally in value sectors, where weightings are higher due to a prevalence of more traditional industries, as growth and high-tech sectors have lagged.

EM performance steady rather than stellar

Emerging markets have been mixed with countries like China able to handle the pandemic well (Non-manufacturing activity expanded for 11 months in a row, while export growth is 32% above trend), to countries like Brazil, which is currently riven with both political uncertainty and a laissez faire attitude to Coronavirus control. On the other hand, India’s economic and market outlook remains positive as the government seems to want to avoid any major lockdowns. At the moment, It appears that the second wave will not meaningfully diminish the strong economic bounce back, which is bolstered by the government’s loose fiscal stance. India has one of the strongest real GDP growth outlooks globally with 12.5% upside between now and 2022.

Return to inflationary environment

When constructing multi-asset portfolios the spectre of rising interest rates, when both equities and bonds are expensive, is daunting. The fear of inflation has been affecting bond markets since the beginning of this year yet it has seemingly been ignored by equity markets. As we begin to see economic recovery accelerating with companies and consumers holding record cash in reserve we expect there will be upward pressure on prices.. Whether this translates to sustained inflation is, currently, the most debated point of all amongst investors. The risk that it does, is enough to justify our current cautious stance. Any further rebalance, lowering exposure, needs to be well timed and short lived. With current valuations already pricing in an almost perfect scenario we think the opportunity cost of lowering risk further is low.

The Rivers Outlook

We are seeing strength in many markets both developed and emerging and indices are hitting new all-time highs driven to a large extent by momentum and money flows but we think that some caution is warranted. We have positioned our portfolios to take advantage of the upside in the markets while still protecting our clients’ capital on the downside. We believe that given the underlying structural shift in the market driven by inflation fears and exuberant valuations we will see more volatility which will provide good opportunities for us to deploy into those asset classes like value and subsectors like energy, semiconductors and consumer discretionary, where we believe there are still potential returns to be found.